Frappe

Products

Lending

Get started with Frappe Lending

Frappe Lending

Open source loan management system

stars ·

18

contributors

What is Frappe Cloud?

Application + Infrastructure

benefits

Why Frappe HR?

100% open source

Frappe HR is a 100% open-source HR & Payroll product, offering you complete transparency and flexibility. Backed by a community of over 20,000 developers and 180 partners, there will never be a struggle for solutions

Affordable & inclusive

Say goodbye to overvalued SaaS solutions with inflated per-user pricing. With Frappe HR, your software expenses wouldn’t grow as your team grows. Deliver the best employee and HR experience with a product designed for everyone in the organization

Highly customizable

Configure and customize to your liking. Create reports, forms, custom fields, print formats, and change layouts on the fly!

Easy integrations

Cut ties with disparate payroll and accounting systems to save hours of reconciliation work. Frappe HR promises integrated accounting with ERPNext every step of the way. Integrate with biometric tools, banks, or any third-party software

Powered by the low-code, no-code Frappe Framework

Frappe framework enables you to build your own forms, set up advanced approval workflows on any form, manage roles and permissions, set up notifications and reminders, and build reports and dashboards to meet all your needs

All in one HR suite of products

Stop paying licensing fees for 10 different products. Manage all your HR and Payroll operations from one single dashboard and an easy-to-use mobile app. Right from recruitment to exits, managing rosters to payroll - we have got you covered

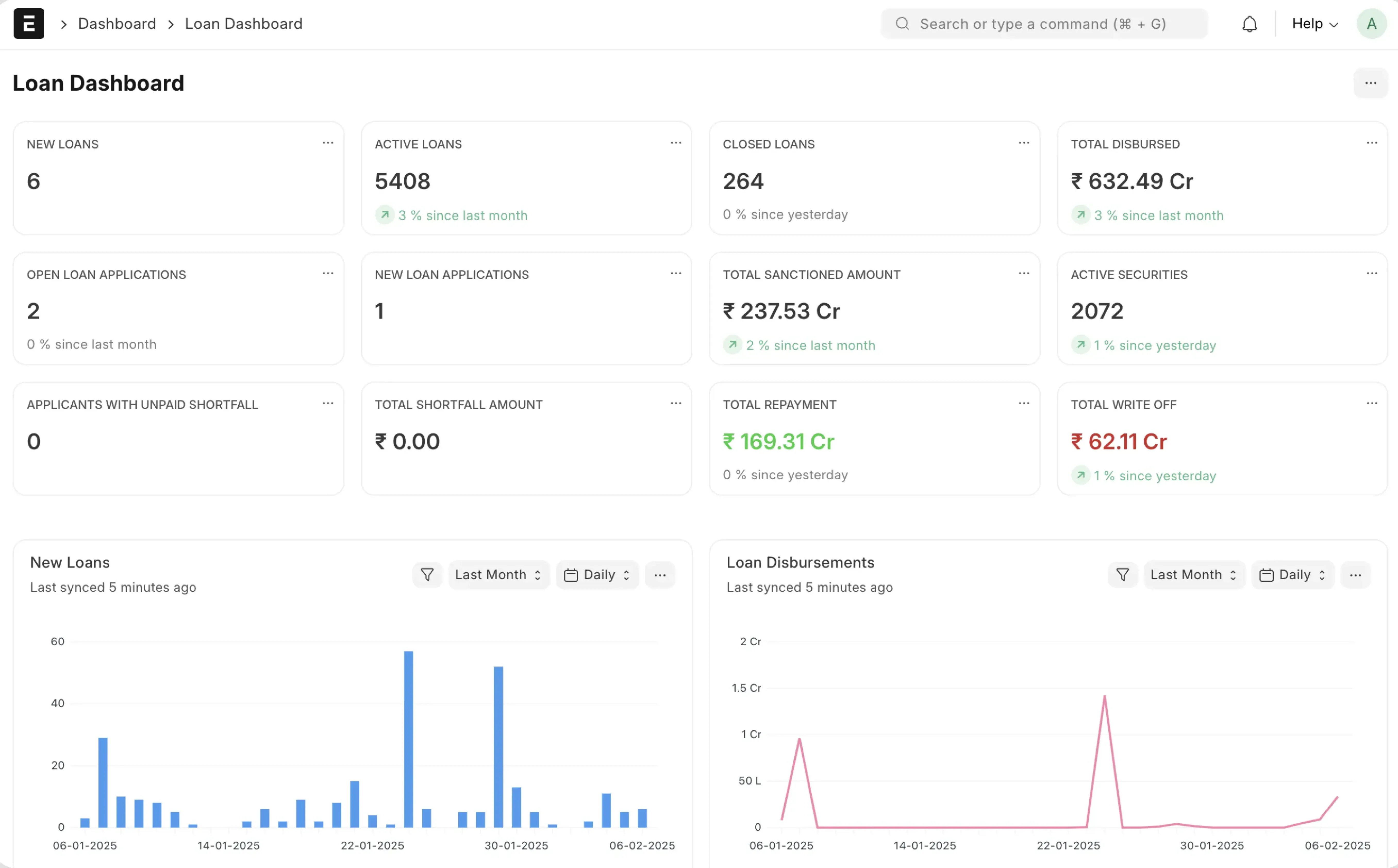

Frappe Lending is a 100% open-source loan management system that automates the entire lending lifecycle—from loan booking and disbursal to repayment tracking, compliance, and reporting. Manage personal loans, business financing, and co-lending—all in one place.

What is Frappe Cloud?

Application + Infrastructure

benefits

Why Frappe Lending

1

100% open source & API-first

No licensing fees, no vendor lock-in—customize, extend, and integrate with ease.

2

Scalable & trusted

Designed for high-volume lending, used by Zerodha, Kinara Capital, and other leading institutions.

3

Complete loan & financial management

Manage loan origination, disbursements, repayments, and accounting—all in one place.

4

Built-in compliance & risk monitoring

Automated DPD tracking, NPA classification, and regulatory reporting ensure compliance without manual effort.

5

Accounting, billing & taxation

Integrated ledgers, invoicing, and tax handling keep your financials accurate and audit-ready.

6

Custom workflows & role-based access

Define approval steps, automate processes, and control access with role-based permissions, ensuring smooth and secure operations.

What is Frappe Cloud?

Application + Infrastructure

features

What Frappe HR has to offer you

Recruitment

Growth made easy: plan, publish, analyze, engage, evaluate & hire

Employee lifecycle

From onboarding to exits, transfers to promotions, we've got your back every step of the way

Shifts & attendance

Mobile check-ins, roster management, and auto attendance

Leave management

Manage holidays, complex leave policies and encashments

Expense management

Payout advances, streamline travel and expense accounting

Performance management

Plan goals & KRAs, create appraisals and ensure continuous feedback to help employees grow

Payroll

Map diverse pay structures, employee loans & run accurate payroll with integrated accounting

Income tax

Configure regional tax regulations & stay informed at all times with tax computation & projection reports

Mobile app

Access Frappe HR from the convenience of your smartphone

What is Frappe Cloud?

Application + Infrastructure

features

What Frappe HR has to offer you

Recruitment

Growth made easy: plan, publish, analyze, engage, evaluate & hire

Employee lifecycle

From onboarding to exits, transfers to promotions, we've got your back every step of the way

Shifts & attendance

Mobile check-ins, roster management, and auto attendance

Leave management

Manage holidays, complex leave policies and encashments

Expense management

Payout advances, streamline travel and expense accounting

Performance management

Plan goals & KRAs, create appraisals and ensure continuous feedback to help employees grow

Payroll

Map diverse pay structures, employee loans & run accurate payroll with integrated accounting

Income tax

Configure regional tax regulations & stay informed at all times with tax computation & projection reports

Mobile app

Access Frappe HR from the convenience of your smartphone

What is Frappe Cloud?

Application + Infrastructure

features

What Frappe HR has to offer you

Recruitment

Growth made easy: plan, publish, analyze, engage, evaluate & hire

Employee lifecycle

From onboarding to exits, transfers to promotions, we've got your back every step of the way

Shifts & attendance

Mobile check-ins, roster management, and auto attendance

Leave management

Manage holidays, complex leave policies and encashments

Expense management

Payout advances, streamline travel and expense accounting

Performance management

Plan goals & KRAs, create appraisals and ensure continuous feedback to help employees grow

Payroll

Map diverse pay structures, employee loans & run accurate payroll with integrated accounting

Income tax

Configure regional tax regulations & stay informed at all times with tax computation & projection reports

Mobile app

Access Frappe HR from the convenience of your smartphone

What is Frappe Cloud?

Application + Infrastructure

features

What Frappe Lending has to offer you

Loan Products & Management

Create and manage flexible loan products with customizable terms, interest rates, and repayment options.

Loan Operations

Streamline the entire loan lifecycle from application to disbursement and repayment.

Collateral & Security

Track and manage collaterals, guarantees, and securities linked to loans.

Financial Accounting

Ensure accurate financial tracking with automated entries and real-time reporting.

Billing & Taxation

Automate billing, interest calculations, and tax compliance for seamless transactions.

Risk & Compliance

Mitigate risks with credit assessments, regulatory compliance, and fraud detection.

Co-Lending & Loan Transfers

Facilitate partnerships, co-lending models, and efficient loan portfolio transfers.

What is Frappe Cloud?

Application + Infrastructure

from the author

Story of Frappe Lending

"Frappe Lending started as a module in ERPNext, built for one of our early users who wanted a lending system that felt familiar and leveraged the power of the Frappe framework. We began with a simple LAS module to manage loans and collaterals, gradually expanding it to cover the entire loan cycle. Like everything we build, this was open-source from day one.

As we worked on this, we saw a bigger opportunity. The market lacked a flexible, open-source lending solution, and more businesses were looking for alternatives to rigid, expensive platforms. So, when a major NBFC in India approached us with the need for a full-fledged lending system—including amortization schedules, loan portfolios, and co-lending modules—we knew it was time to take the next step.

Instead of keeping it as just another ERPNext module, we spun it off into its own product. That’s how Frappe Lending was born—an open, adaptable platform built for the future of lending."

Product Engineer

user reviews

Take it from our users

Trusted by India's Largest Stock Broker

Hear it from Zerodha

Labeeb Mattra

Senior Software Engineer, Zerodha

“Building our Loan Against Securities service with Frappe Lending was a great experience. We could create custom on-boarding, loan application, and loan management workflows easily using out-of-the-box features that Frappe Framework & Frappe Lending provided.

Integrating the system with customer-facing apps using Frappe REST APIs was effortless and time-saving for us. Frappe team is very proactive in addressing our requirements and suggestions regarding the loan management module.”

Kurian Jacob

TinkerHub

"TinkerHub needed an LMS platform for our 15K+ community members. We recently migrated to Frappe LMS and have been thrilled with the results. The process was incredibly easy and fast, and we were able to customize our courses in a way that we couldn't before. The fact that it's fully open-sourced has been a game-changer for our non-profit organization. We highly recommend Frappe LMS to anyone looking for an efficient and cost-effective solution."

View all testimonials

Ready to scale your lending business?