Over the past decade, as digital lending has taken off, so has the complexity of the software used to run it. Many institutions, whether NBFCs, microfinance operators, or fintech-backed lenders, rely on a patchwork of closed systems. They’re powerful, yes, but they come with high licensing costs, rigid workflows, and long implementation timelines that make even small changes feel like strategic decisions.

Some spend months integrating a new co-lending model or generating the correct credit bureau exports. Others shell out hefty fees just to modify repayment schedules or interest logic. And when growth kicks in, adding new loan products or automating collections often means calling in a vendor or consultant.

This complexity, ironically, becomes a bottleneck. And it’s costly.

We’ve heard of teams spending $30k to $50k a year, sometimes more, just to keep their loan management systems operational. And in many cases, they’re still using spreadsheets to plug the gaps.

A Different Approach

Frappe Lending was built to offer something different: a full-featured Loan Management System that you can actually understand, own, and evolve.

It’s 100% open source. That means there are no black boxes. No restrictive licenses. No waiting for a roadmap that may or may not include your needs. You get the freedom to self-host, customize, and integrate based on how you run your lending business, not how your software vendor wants you to.

But more than being open, it's also practical.

Lenders using Frappe Lending today are managing tens of thousands of live loans, disbursing hundreds of new ones every day. Whether it’s a simple EMI product or a more nuanced structure with moratoriums, collateral, or co-lending splits, the system is designed to handle it.

You don’t need to start from scratch, either. Frappe Lending comes with the core building blocks already in place: loan creation, disbursal tracking, automated repayment schedules, interest calculations, collections, reconciliation, and credit bureau file generation. All customizable, if and when you need them to be.

Built for lenders who want more control

Frappe Lending runs on the same foundation as ERPNext: the Frappe Framework. This gives you a robust, secure, and enterprise-grade backbone to build on. Role-based access, document versioning, audit logs, and integration-ready APIs.

While it's a developer-friendly platform, it’s made for teams who want better visibility into their portfolios, more agility in launching products, and a system that can actually keep up with their growth.

Think of the time you spend working around your existing software. Then think of the time you could save if the system were designed to work around you.

Simplified Loan Life Cycle

Frappe Lending isn’t a monolithic block of software. It’s a modular, event-driven system that’s meant to mirror how real-world lending works.

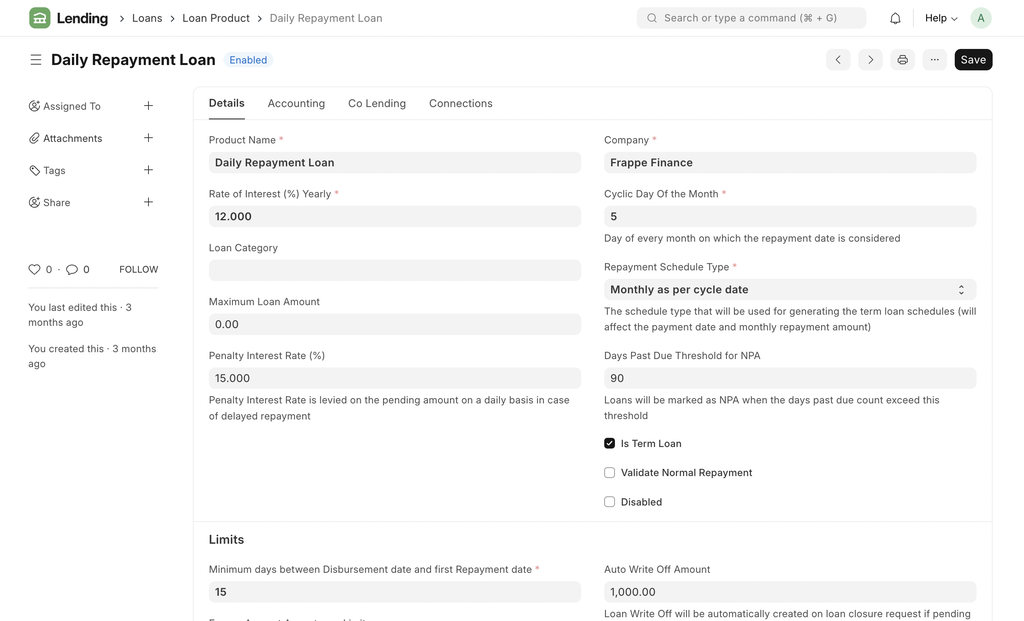

You start by setting up loan products, something your credit team defines, maybe with a flat interest rate or a reducing balance method, maybe with processing fees or security deposits. The platform allows you to configure all of this intuitively.

Once a customer is onboarded, booking a loan is a matter of a few steps. You capture all the key terms, disburse amounts either fully or in parts, and the system takes over, generating a repayment schedule that reflects your product logic, whether that’s EMIs, bullet payments, etc.

As repayments begin, Frappe Lending handles interest accruals, EMI allocations, and overdue penalties automatically. Payments can be recorded manually or synced through external payment systems using integrations.

And if a customer defaults or misses payments, the system updates their DPD (Days Past Due), flags the account for review, and tracks provisioning rules. It’s built to support regulatory processes too, like classifying NPAs, generating write-offs, or doing NPA suspense accounting as well.

If you're working with a co-lending partner, the system helps you track ledgers and settlements across lenders. No need for custom spreadsheets or late-night reconciliations.

And if your team prefers working through APIs or building a custom frontend, Frappe Lending comes with a RESTful, developer-friendly interface because the product is as much for engineers as it is for operators.

It’s battle-tested for real-world scale

Frappe Lending isn’t just a prototype; it’s already running in production at institutions that operate at significant scale. Some of our early adopters are managing portfolios of 50,000+ active loans, with daily operations generating over 100,000 accounting entries.

That includes disbursals, repayments, interest accruals, provisioning, and more, all processed automatically and mapped accurately to their ledgers. Accounting and loan servicing don’t live in silos here; they’re part of one streamlined system. No syncing. No double entry. No reconciliation nightmares at the end of the month.

For these teams, the loan management journey has moved from fragmented and reactive to integrated and largely hassle-free. And because the platform is open and adaptable, they’re able to evolve their workflows continuously.

Looking for something similar?

Frappe Lending isn’t a magic fix. But it is a fresh start, a way to build a system around your lending business, not the other way around.

If you are interested in seeing this live in action, please request a demo

·

Interested in seeing live demo. Thanks

·

Sounds great and logical from a technical and business/banking perspective. I don't know the legal requirements for loans in the country/ies the system is used, but please see to it that the system clearly tells the clients how much they pay for the whole thing, and this not in some percentage of interest, but as the total sum of all interested combined over the whole duration. This because exponential functions are very hard to get an intuitive feeling for. Once upon a time (but for real), I myself (with a scientific background in math, physics, etc.) got abused by a financial person I signed a credit deal with. I calculated the whole thing before and felt confident I understood the whole thing, but in the last minute the guy unexpectedly suggested to split the credit in two parts with slightly different interest rates. I agreed (there was no time to really recalculate the thing at signature moment, and it somehow sounded nice), and this cost me quite some additional money when calculation the total interest combined. Only a slight difference in interest rate it was. So, please help the clients by spelling things out clearly. This is rarely done, and I'm sure many people get abused because they do not really understand what they sign. Interest rates, interest on interests, and these EMIs are counter-intuitive for most of the people, for instance for EMIs, most people don't realize that they pay lots of interest first before, only later, they really start to pay down the principal. It's may sound nice to have equal monthly payments, but the effect on the interests sum is big; and nobody knows the future anyway, but there is a lot of trickery at work to shift risk to other people. This needs large-scale public education, even websites to better show how all these work, and the total cost of credits and such. We're looking at large-scale lack-of-knowledge abuse by interested parties. It's a humanistic endeavor.