Our story began with a personal challenge: helping my father manage vendor payments—a task filled with multiple payment modes, juggling online transfers, cheques, and manual RTGS forms. This experience was the spark that ignited our quest to simplify payments for SMBs.

The Payment Maze: A Personal Story

I remember watching my father at work—carefully switching between ERP and online portal, double-checking beneficiary details, and stressing over similar names on payment lists. It was almost like watching a suspense thriller every time he logged into his bank account!

Your Rs 10,000 will self-destruct in 5..4..3..

Here were my takeaways from that experience:

- Multiple payment modes: Online payments, cheques, and manual RTGS forms.

- Context switching: Switching between ERP and internet banking (NetBanking) Portal.

- Inherent risks: Amount mismatches, selecting the wrong party (especially with similar names), and the constant fear of mistakes.

- Time constraints: Payment tasks were squeezed into early mornings or late nights to ensure complete focus, leading to overtimes.

There had to be a better way.

The Initial Experiment

Desperate to ease my father’s burden, we first attempted an unofficial HDFC Bank integration on ERPNext using Selenium.

Making Payment

While it worked—and made him smile— it left us yearning for something more robust and scalable. Later, the hassle of opening a bank account for our company, Resilient Tech, pushed us to look for API first banks. That is when we discovered RazorpayX, a Technology Service Provider (TSP) over traditional banks.

Our Vision

Imagine a world where making payments is as simple as clicking a button. No portals, no beneficiary waits—just click, confirm, done.

Simplicity is the ultimate sophistication. – Leonardo da Vinci

We wanted to build something that was grounded on the following pillars:

- Affordability: No hidden fees, just value.

- Customization: Workflows that adapt to your business.

- Efficiency: Could reclaim 80% of your payment processing time.

We initially planned to build a single app that would integrate RazorpayX with ERPNext, but we ended up developing three apps instead, that could solve more generic problems in connected bankings.

RazorpayX Integration

Why RazorpayX?

We randomly signed up on the RazorpayX portal for our Bank Account. Our first encounter turned out to be refreshing, as it had:

- Real banking: Unlike typical wallets, RazorpayX allowed us to maintain our balance with a RBI-registered bank, preserving the authenticity of our banking operations.

- Bulk payments: A simple Excel upload was all it took to manage bulk payments.

- Payout links: Pay anyone with just their contact details.

- No beneficiary activation: Instant payouts without waiting to activate a beneficiary

- Transparent pricing: No Saas fee, No onboarding fee — just a small fixed fee per transaction.

(Psst… We negotiated special pricing for the community, you can fill this form to access it)!

And then came the “aha” moment—let's integrate this directly into ERPNext.

Integration with ERPNext

We started with a simple goal in mind create a payment integration that fits seamlessly into any organization’s workflow, no matter how complex:

- Need complex approval workflows? We offer a basic workflow template, fully customizable to your organization’s needs.

- Custom alerts: Automatically notify vendors once payment is processed. Alternatively alert the authorizer if a payment reverses or fails.

- Bulk authorization: Easily authorize payment entries in bulk in one go.

- Auto fees accounting: RazorpayX Fees are accounted for automatically, ensuring they reconcile with the bank automatically.

- Secure: By whitelisting IPs and using 2FA and role permissions, you can ensure that only your server and authorized users can process payments.

Make Payout on Payment Entry Submission

All of our problems were magically solved by having payments flow directly from ERP. Most fields, including party bank accounts, were automatically populated based on the defaults, and the amount to pay was pulled from the Purchase Invoice. This was a true Eureka moment for us.

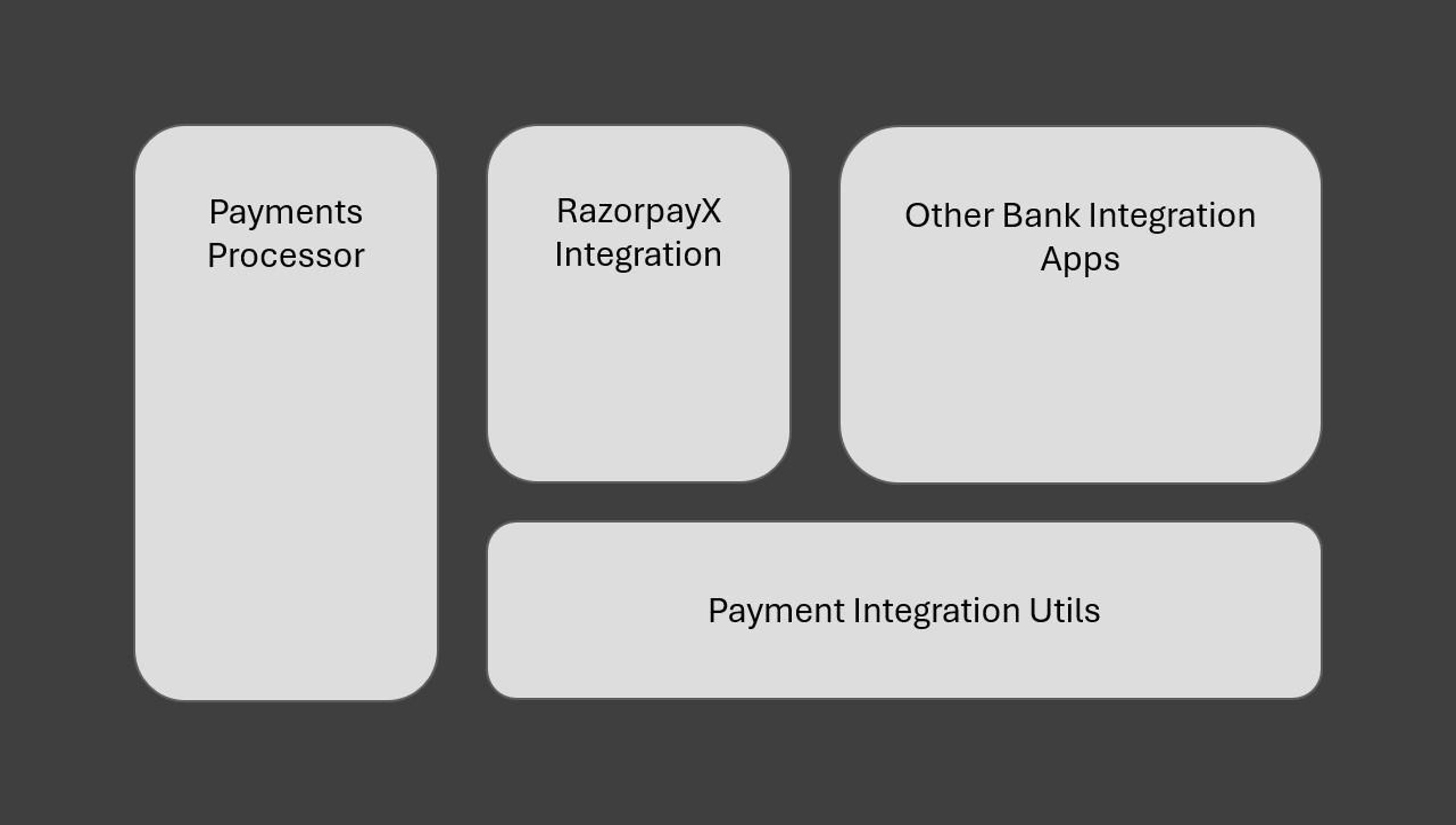

Splitting a Monolith into Purpose-Built Apps

Starting as a single app, our tool soon outgrew our initial plan. We faced two pivotal questions:

How will we manage multiple integrations in the future without duplicating work?

➔ Answer: Split off the core integration logic into a separate module: Payments Integration Utils.What if a business needed smart automation without direct bank integration?

➔ Answer: Create a Payments Processor app, a tool designed to analyze invoices, manage cash flows, and send full email reports with a bird’s-eye view.

Architecture of Apps

Payments Processor

While RazorpayX made payments a cinch, we still needed to answer a critical question: How do we determine which invoices to pay? That is where we built the Payments Processor app—a smart, configurable tool designed to make invoice management as smooth as the payments themselves.

Key features include:

- Configurable limits: Set limits to automatically generate or submit payments based on your business rules.

- Customizable party settings: Tailor which vendors or parties get processed based on your preferences.

- Hold invoice payments: Pause and review invoice payments whenever needed.

- Early payment discounts: Claim discounts by ensuring timely payments.

- Hookable & customizable: Integrate seamlessly with your existing workflows and tweak it to your exact needs, thanks to the flexibility of Frappe Framework.

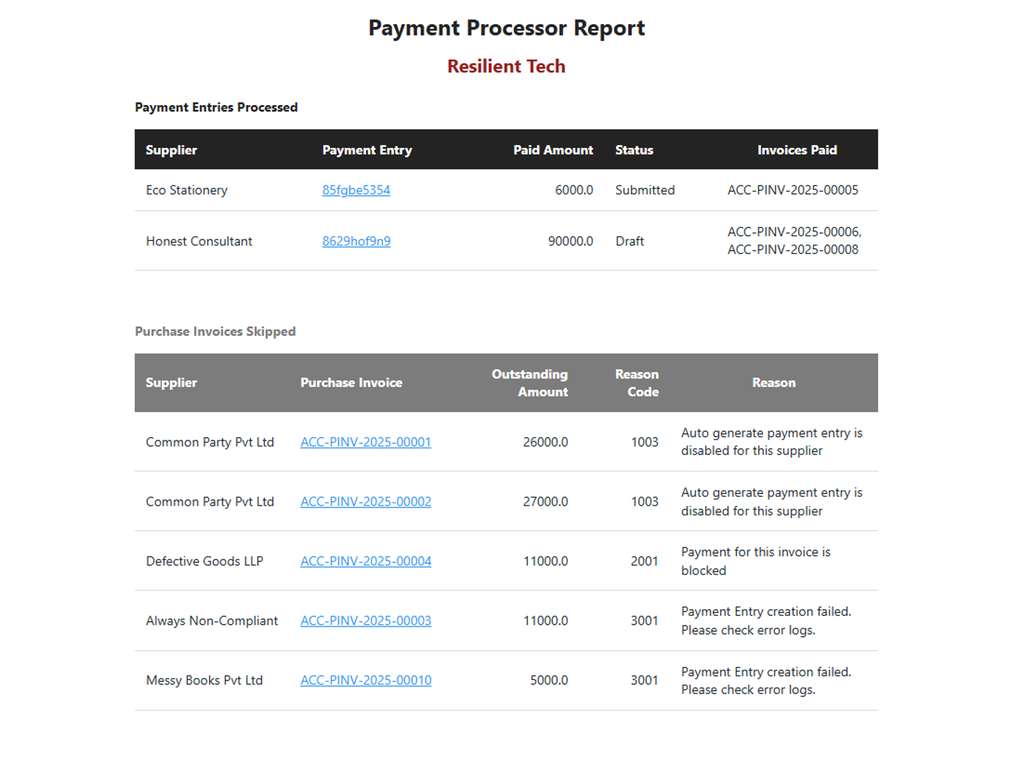

- Bird’s eye email reports: Receive comprehensive reports that provide a quick overview of successful actions and any hiccups along the way.

Email Report

Join the Revolution

We’ve open-sourced our entire toolkit because innovation thrives when we collaborate and that technology should be accessible to everyone. We want to ensure that no one else faces the struggles we did.

Get Started:

- One-click setup – Deploy on Frappe Cloud.

- Contribute on GitHub – Code, feedback, and ideas welcome!

- Star the repo – Because even code loves appreciation!

With ♥️ by the team behind India Compliance App.