Frappe

ERPNext

ERP Guide

Business Sustainability

Chapter 1

The importance of business sustainability

industry

Chapter 1: The importance of business sustainability

Before we delve into understanding the ‘what-how-where’ of an ERP, it’s essential to understand the ‘why’. Starting a business is a difficult task in itself, but sustainably growing one is a whole different challenge.

Let’s look at it from the perspective of a business called Spindl.

How did Spindl come into existence?

It starts with a tale of two long-lost friends. Saf and Mel had toiled away in their respective industries for years. They’ve done it all. The trajectories of their lives had become consistent, yes, but ultimately unfulfilling.

One weekend, just as she walked into a Saturday-night social event, Saf saw a familiar face.

Mel, an old friend from college. A face that brought the fondest of memories to mind.

Product Catalog

And so it began: conversations about growth, changes, family, nostalgia, and frustrations. Their shared love for art and clothes, a disdain for increasingly unsustainable clothing trends, and mutual boredom of their stagnating work-life gave birth to something special, an idea to start a company!

They called it Spindl. In a market dominated by fast fashion giants, Spindl had something unique to offer—a clothing company driven by longevity and sustainability.

Saf and Mel decided to put capital into their business idea. It was risky, but they believed in it. After sourcing seed investments from families and local contacts, and putting their own money in, they realized they’d need more. So they turned to investors. It wasn’t an easy job; it took them many months of planning, ethically sourcing yarn, creating solid proof of concepts, and going to investors after investors to build the company of their dreams.

With their initial seed funding secured, Saf and Mel laid the groundwork for their business. They began hiring and training employees, securing supply contracts, setting up infrastructure for production, reaching out to distributors, started some marketing, and so on. It took a while for them to kickstart production between looking for quality suppliers and setting up manufacturing, but they got it done with some persistence.

Eventually, they had everything they needed to set up a smooth-functioning manufacturing business. They decided that instead of spending on traditional advertising, they would focus their attention where they knew their audience will be receptive—social media. Striking deals with local influencers to test and wear their clothing before launch helped them gain both traction and validation.

Their proposition was simple: in this day and age, sustainability is paramount; with their clothes, people had the chance to build a long-lasting, yet chic closet, at a competitive price. A few weeks after their website went live, it looked that they had a hit on their hands.

A growing business

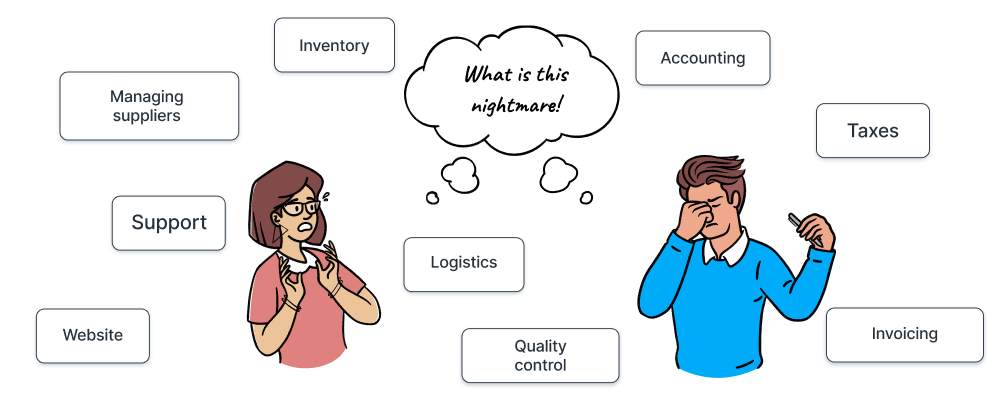

Two years in, Spindl found itself getting lost in the inevitable labyrinth of logistics and managing papers. Their daily responsibilities look something like this:

Managing suppliers

Managing raw materials

Managing the production floor

Managing orders

Inventory Management for orders

Accounting

Invoicing

Payroll and taxes

Managing customers

Managing employees

Quality control

Delivery logistics

Support for customers

Managing the website

Product Configuration

What started as an ambitious project was bogged down by growing logistical nightmares. Spindl loses its most important strength, the time to innovate. After all, being in the garment industry means they have to keep their limited catalogues up-to-date with the changing fashion landscape. Instead, they spent all of their time trying to keep their business functioning at its current scale. In other words, managing the operations had become a bottleneck for their growth and innovation.

It’s not something they immediately catch onto. After all, it seems to them they’re getting good sales. A diminishing flow of cash only makes itself apparent when things start to get dire.

Upon noticing the pattern, Mel decides to have a meeting with Saf and their accounting team. They must analyze what’s going wrong before it’s too late. To accomplish this, Rex from accounting presents the company’s Balance Sheet.

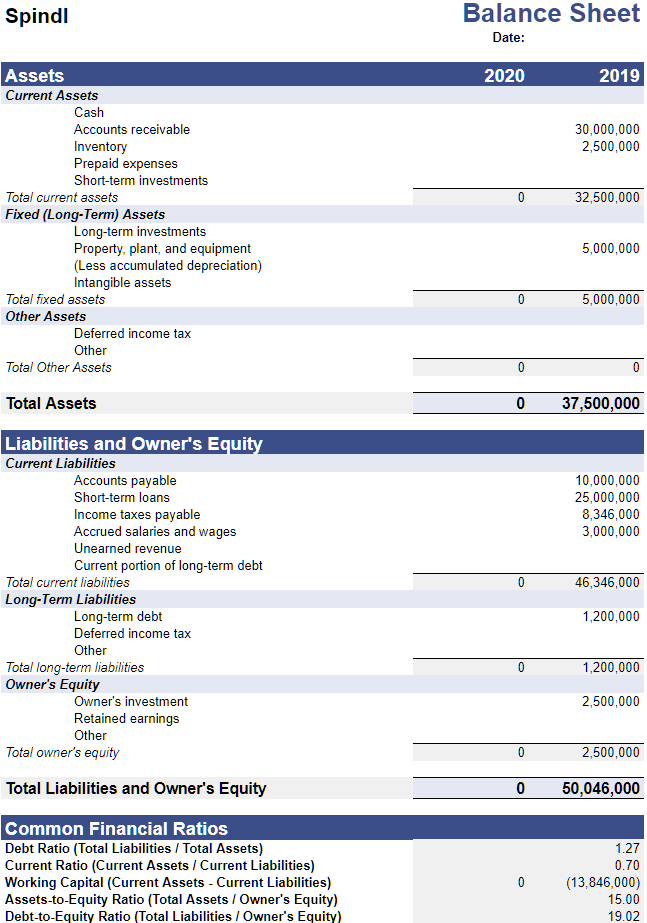

Think of a Balance Sheet as a ‘snapshot’ of a company's worth at a particular point in time. It tells us about their loans and their unpaid bills and the money owed by customers.

Shopping Cart Settings

The illusion of value

Let’s break Spindl’s assets down into current assets (aka short-term assets) and fixed assets (aka long-term assets).

Short term assets include cash in hand, accounts receivable by customers, current inventory stock.

Short term assets include cash in hand, accounts receivable by customers, current inventory stock.

Long-term assets are, as indicated by the name, assets that are meant to last over at least one year (property, equipment, etc.). At the time this balance sheet was released, we see that Spindl barely had any cash on hand. Just enough to cover payroll.

They have been relying on the money they will receive in the future, denoted by 'Accounts Receivable' - a total sum of INR 30,000,000! In their Inventory, they have INR 2,500,000 worth of unsold clothing left in stock. Lastly, they have a long-term asset of INR 5,000,000 in assembly equipment, manufacturing plants, etc. All of this combined brings their total assets to a net INR 37,500,000.

But remember how we mentioned that assets are a sum of liabilities and

owners’ equity?

Everything has a cost

Similar to Assets, there are both short-term and long-term Liabilities.

Spindl has to pay INR 10,000,000 to others for various reasons (for manufacturing contractors, and suppliers), as denoted under 'Accounts Payable'.

Short term assets include cash in hand, accounts receivable by customers, current inventory stock.

On top of that, they also have short-term loans that amount to a staggering INR 25,000,000.

Then come Income Taxes, payable at INR 8,346,000.

They also have Wages to pay to their employees, at a total of INR 3,000,000.

Moreover, there’s the long-term debt of INR 1,200,000, which they’ll need to pay off as well.

And finally, there’s INR 2,500,000 invested under Owner’s Equity—which is the money put in by Saf, Mel, and their initial funders.

All of this brings their total liabilities to INR 50,046,000—a number much higher than their current assets.

But remember how we mentioned that assets are a sum of liabilities and

owners’ equity?

Why this is a problem

The real metric of a successful, low-risk company often shows in the profit (or “retained earnings”) in their Balance Sheet. In simple terms, when spending is more than income, it becomes a slippery slope, one which Spindl has found itself on.

Merely keeping their company afloat is no longer an option for Saf and Mel. They realize that to turn this around, they need to make significant changes to how their company functions. They have to find ways to reduce overheads, streamline processes, and eliminate redundancies to see a shift towards the positive. Without this radical change taking place, they know their company may be seeing

its last years.

But there is fight left in them. After everything Saf and Mel have done, and all the expectations they’ve defied to get their company where it is, they refuse to let this be what brings their passion project crashing down.

Spindl has to pay INR 10,000,000 to others for various reasons (for manufacturing contractors, and suppliers), as denoted under Accounts Payable.

Short term assets include cash in hand, accounts receivable by customers, current inventory stock.

On top of that, they also have short-term loans that amount to a staggering INR 25,000,000.

Then come Income Taxes, payable at INR 8,346,000.

They also have Wages to pay to their employees, at a total of INR 3,000,000.

Moreover, there’s the long-term debt of INR 1,200,000, which they’ll need to pay off as well.

And finally, there’s INR 2,500,000 invested under Owner’s Equity—which is the money put in by Saf, Mel, and their initial funders.

Chic sustainable clothing is the future!

But remember how we mentioned that assets are a sum of liabilities and

owners’ equity?