Sales Return (Credit Note) - Payment Adjustment against New Sales Invoice

By Twinkle Damania on September 13, 2021

IntermediateCredit Note adjustment against new Sales Invoice

Return/Credit Note is created against returned goods. Let’s see how we can create a Credit Note and then adjust it against a new Sales Invoice with an example. Consider a scenario, where we have created a Sales Invoice followed by the Payment Entry for our Customer -> Riya.

Sales Invoice

Customer: Riya

Item: Big Box

Qty: 2 boxes

Rate: 200

Total: Rs.400

Riya wants to return just 1 box worth Rs.200. So we create a Return/Credit Note against the existing Sales Invoice for 1 box. Now we have to refund Rs.200 to our customer.

Instead of refunding the outstanding amount of Rs.200, she wants to purchase a smaller box worth Rs.100 and needs the remaining Rs.100 as a refund.

Let's check out this scenario in ERPNext with steps.

Sales Invoice

Qty: 2 boxes

Rate: 200

Amount (INR): Rs. 400

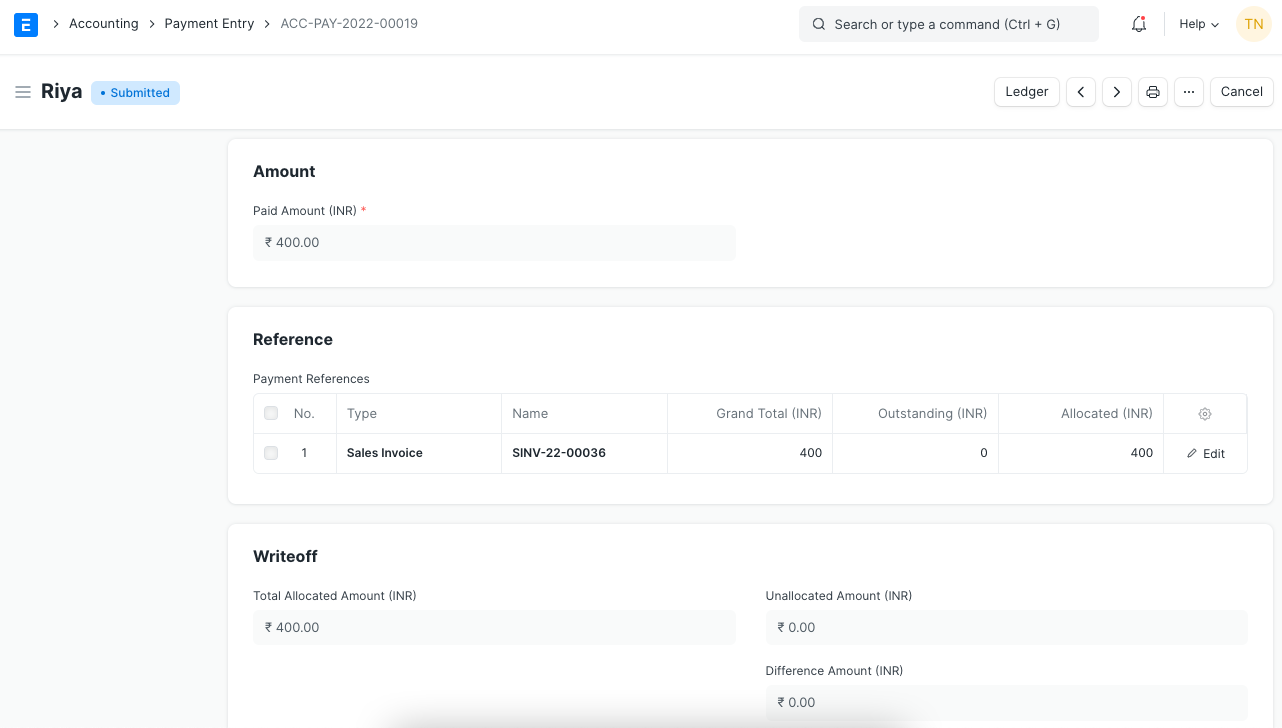

Payment Entry against the Sales Invoice

Now, the Items are returned, so we create a Credit Note.

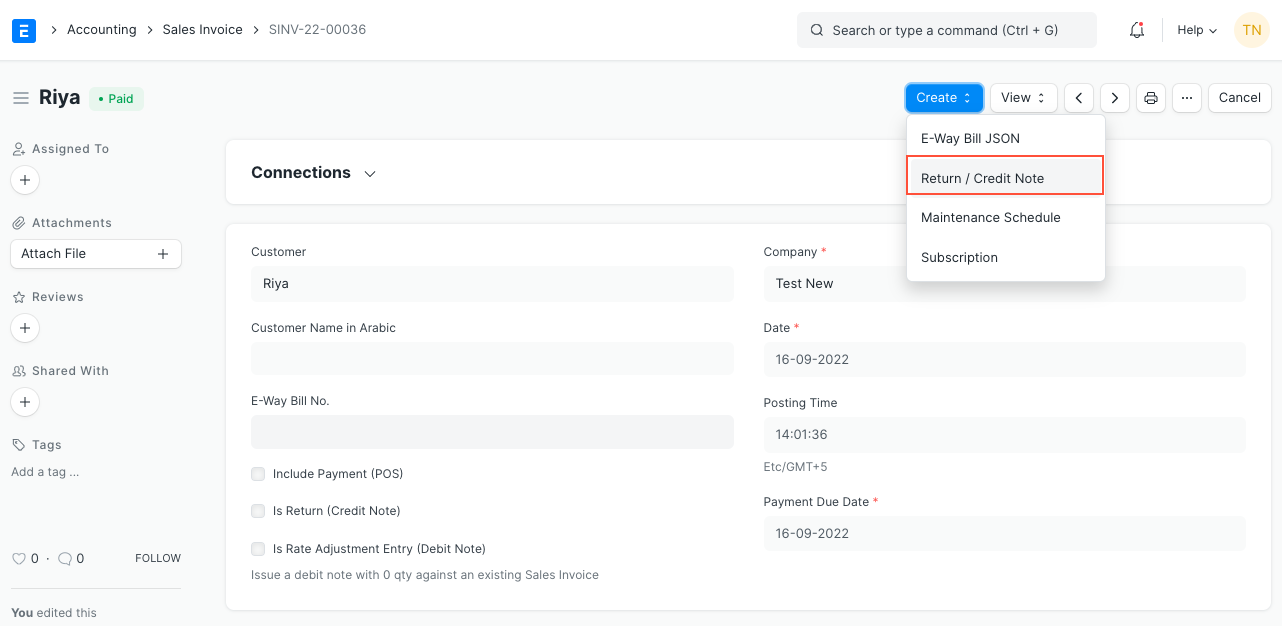

Go to Sales Invoice > Create > Return/Credit Note for

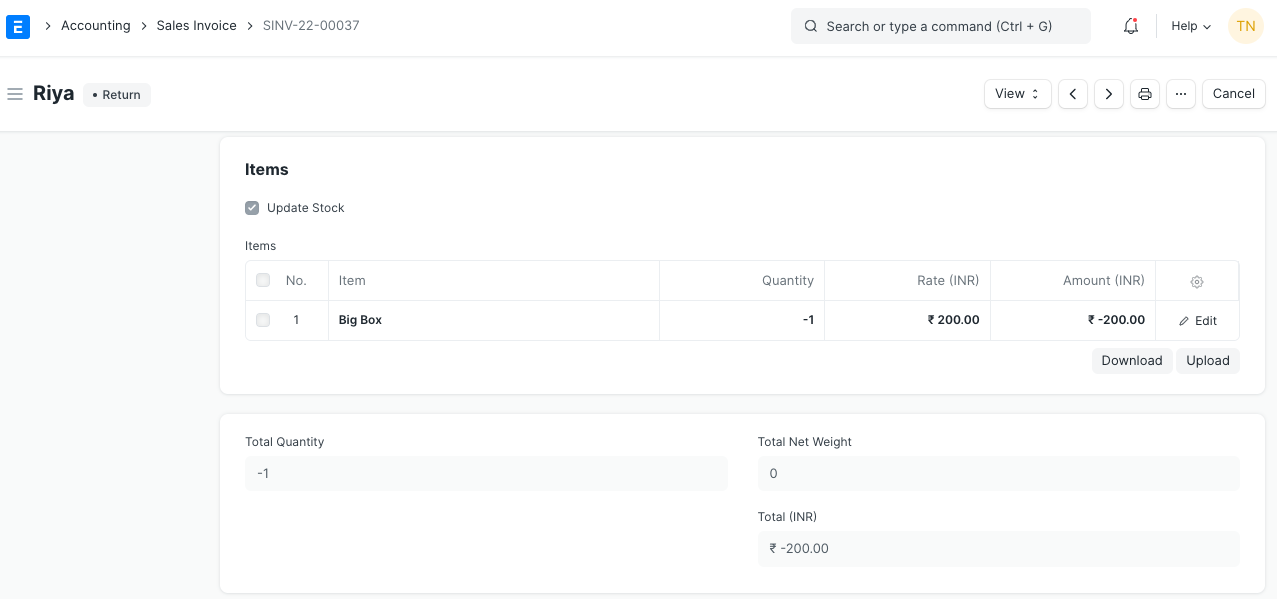

Qty: 1

Rate: 200

Amount (INR): Rs. 200

A Sales Invoice Return will be created for the returned quantities.

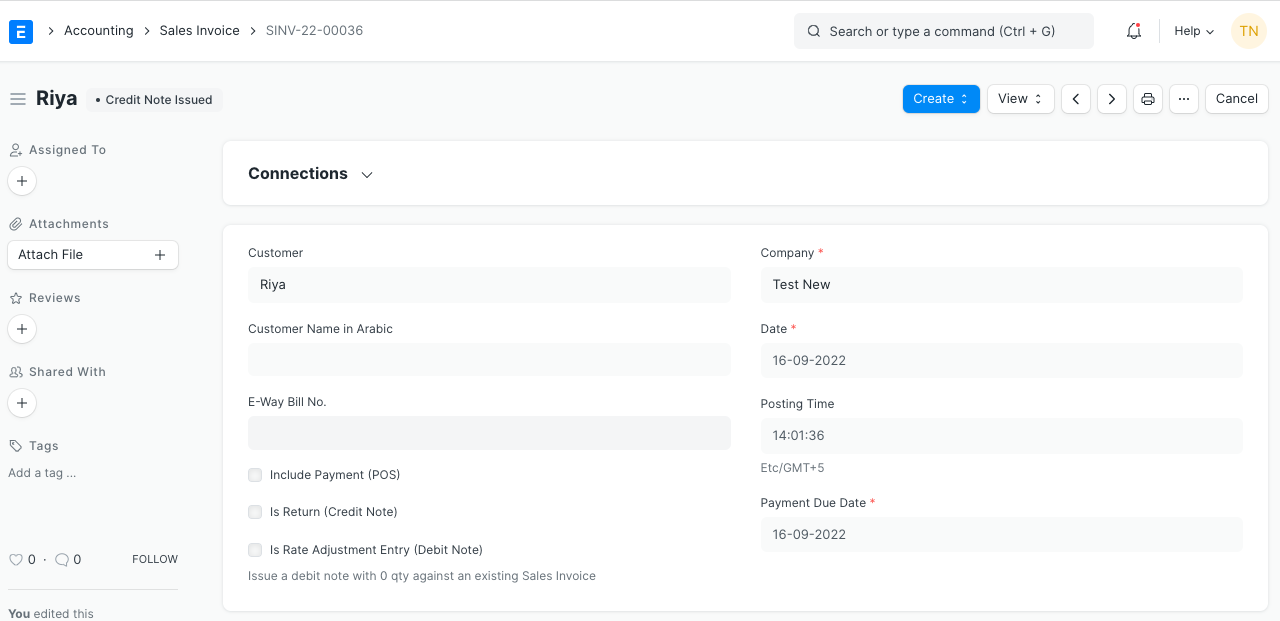

The status of the original Sales Invoice will change from 'Paid' to 'Credit Note Issued.'

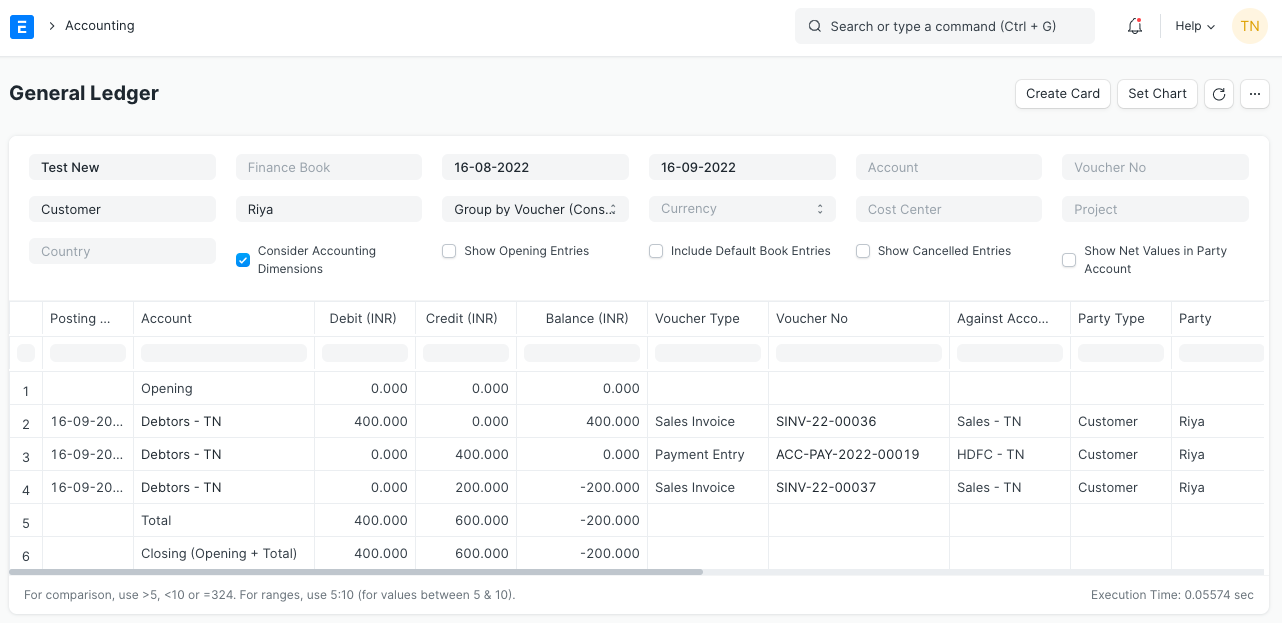

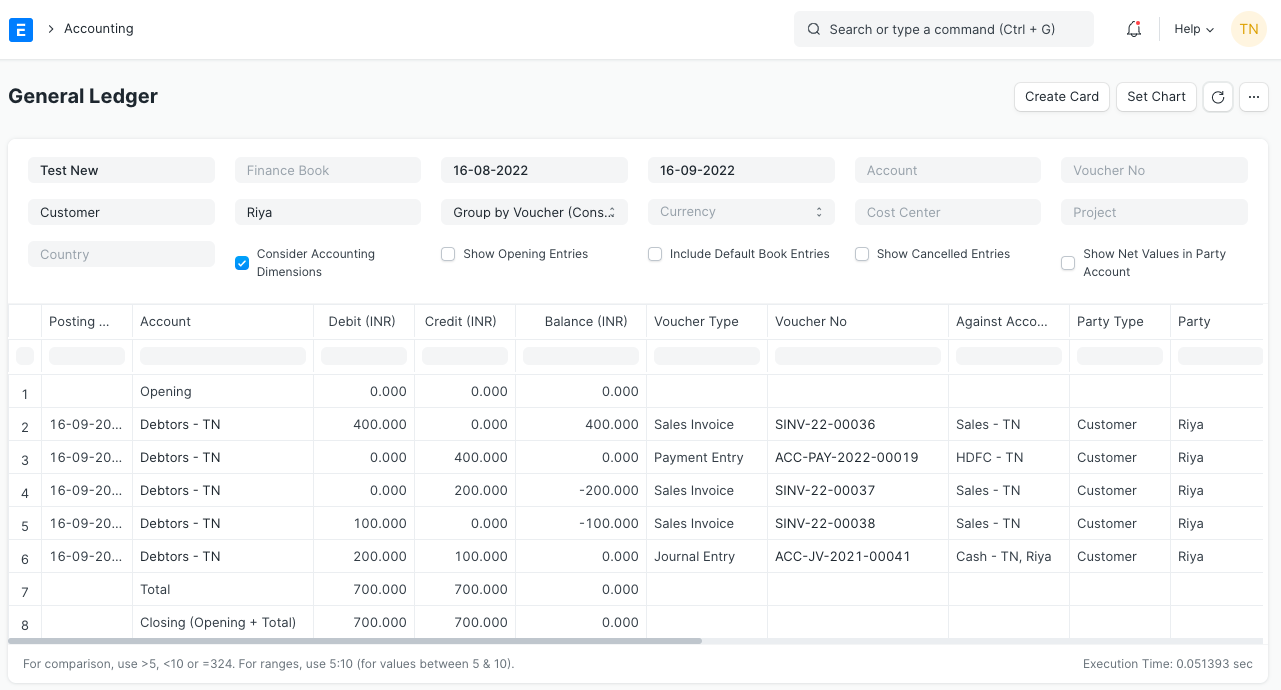

This is the basic procedure where we owe the customer Rs. 200 (credit note created). Below is the Accounting Ledger for the Customer.

Now, the customer wants to purchase a Small Box worth Rs. 100. She asks us to adjust the payment of the Small Box from the outstanding amount and refund the remaining balance.

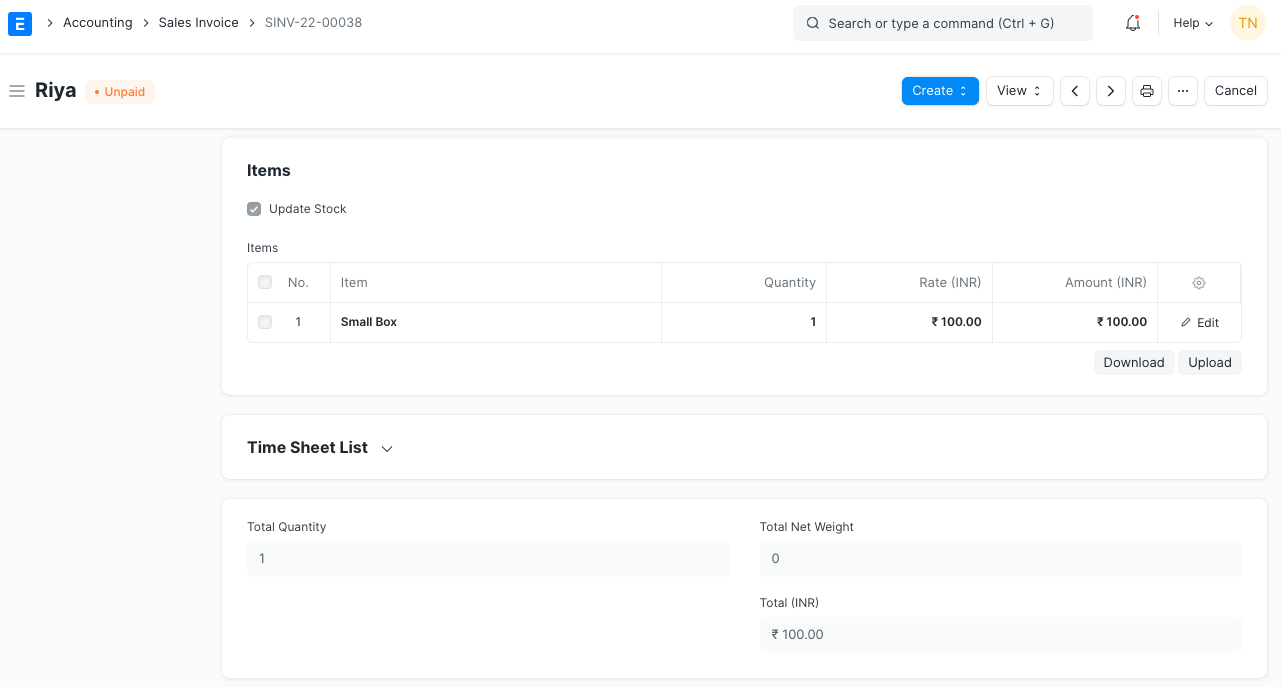

We will create a new Sales Invoice for

Item: Small Box

Qty: 1

Rate: 100

Amount (INR): Rs. 100

The status of the Sales Invoice is 'Unpaid.'

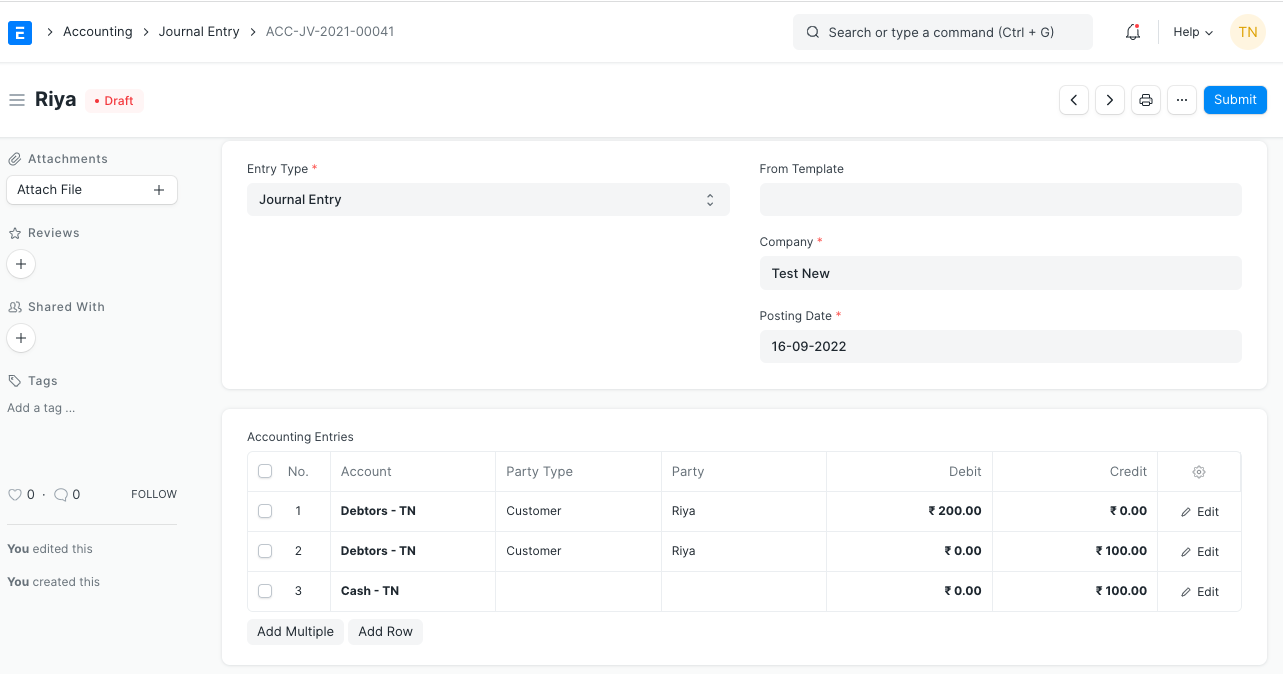

The final step is to create a Journal Entry as below.

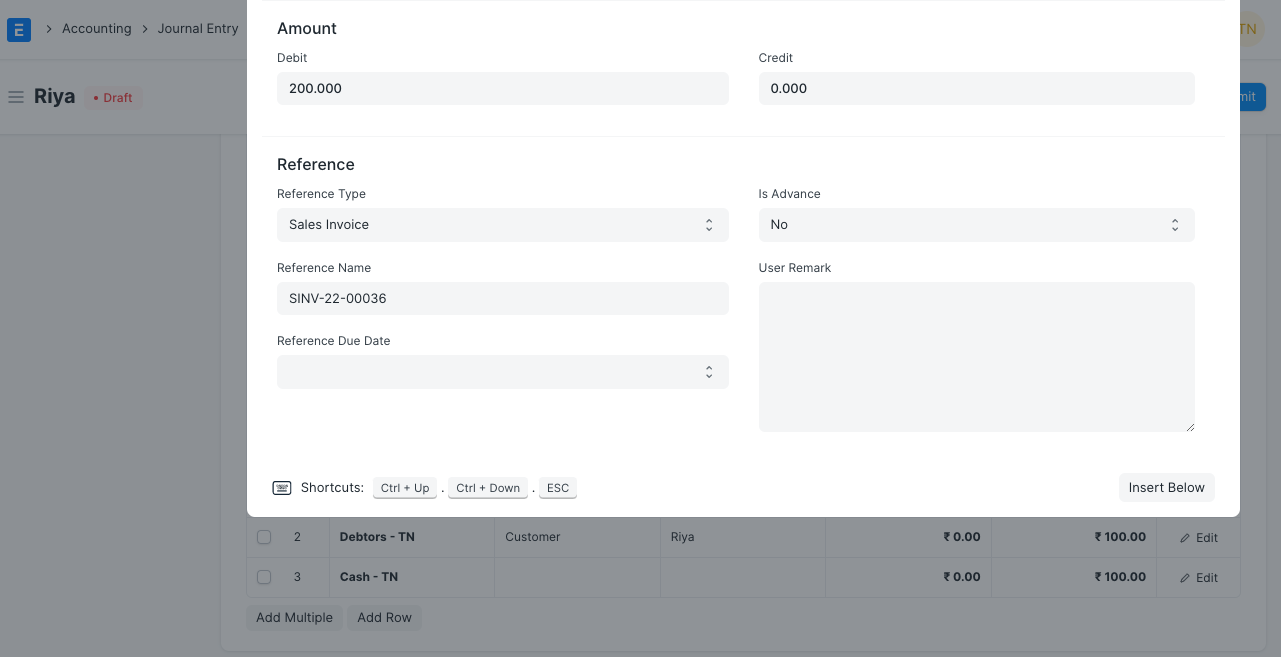

Debtors .. Dr. 200 (Link the old Sales Invoice)

Debtors .. Cr. 100. (Link the new Sales Invoice)

Cash/Bank .. Cr. 100

For linking, click on Edit > add the Reference Type = Sales invoice and select the Reference Name as the old Sales Invoice. Follow the same steps for linking the new Sales Invoice in the 2nd row for Amount: Rs. 100. Linking both of the Sales Invoices is an important step to reconcile

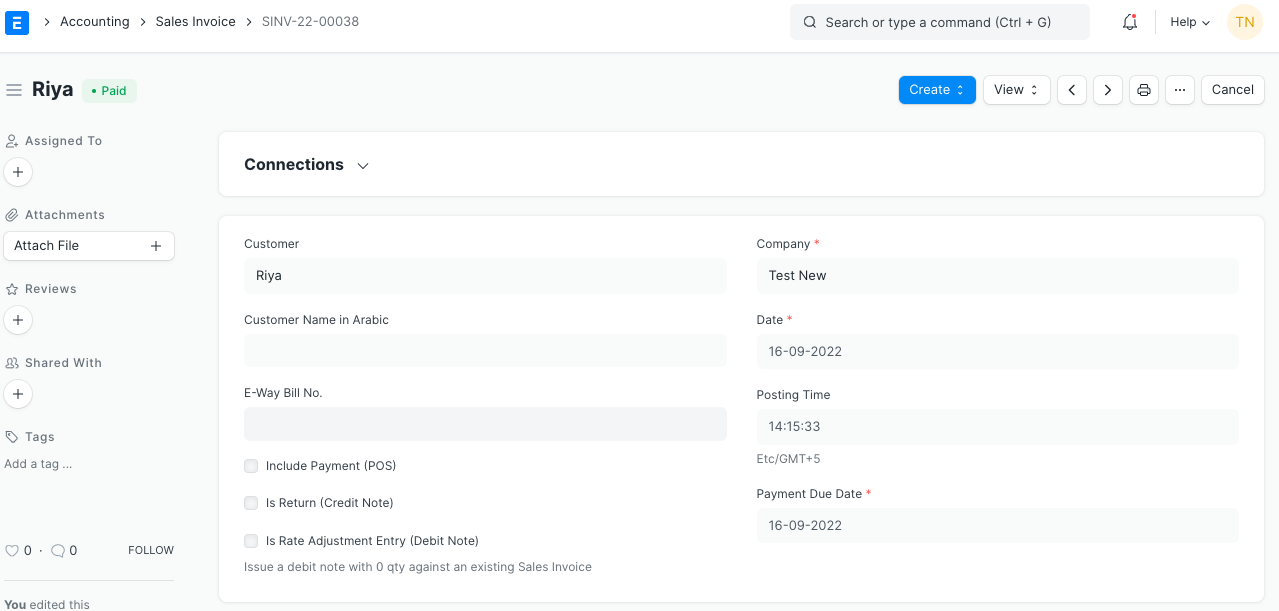

Once the Journal Entry is submitted, you can check the Sales Invoice status which will automatically be changed to 'Paid' and the Accounting Ledger will have 0 Balance.

You can follow the same steps with reverse entries in case of Purchase Invoice returns.

More articles on Selling